|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Should I Refinance My House Now? Exploring the Best Practices and ConsiderationsDeciding whether to refinance your home is a significant financial choice that can impact your monthly budget and long-term financial goals. It's crucial to weigh the potential benefits against the costs and consider your personal circumstances and the current market conditions. This guide will walk you through the essential factors to consider when thinking about refinancing your house. Understanding RefinancingRefinancing is the process of replacing your existing mortgage with a new one, usually with a different lender. It can offer several potential benefits, such as lower interest rates, reduced monthly payments, or changing the loan term. Benefits of Refinancing

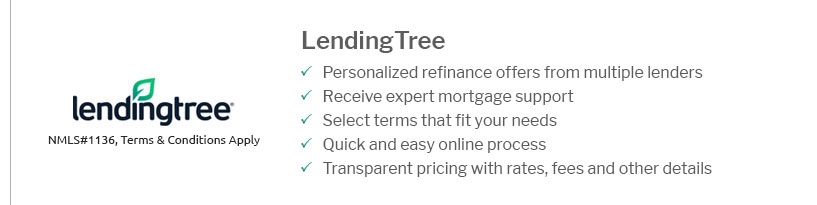

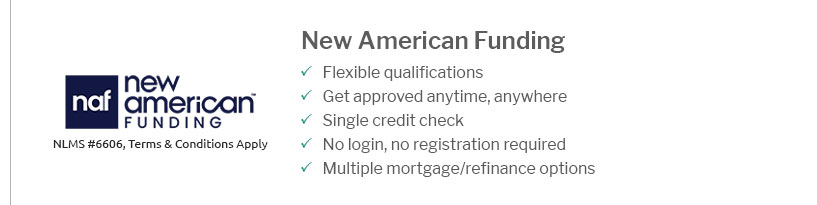

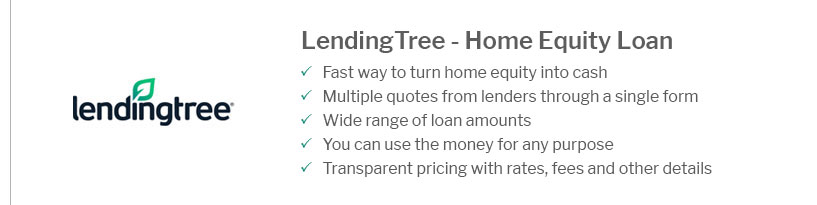

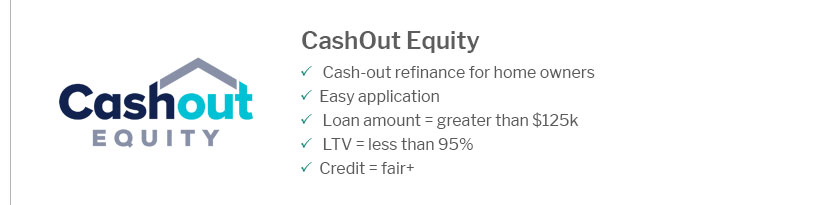

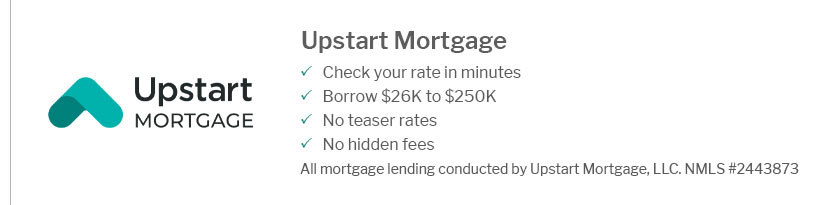

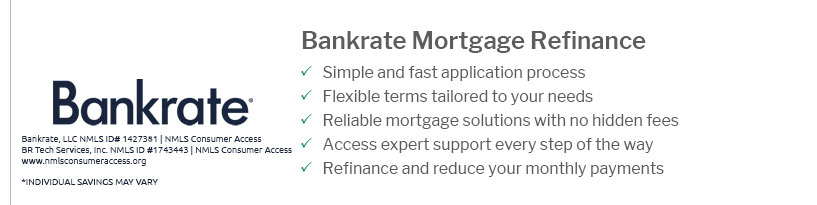

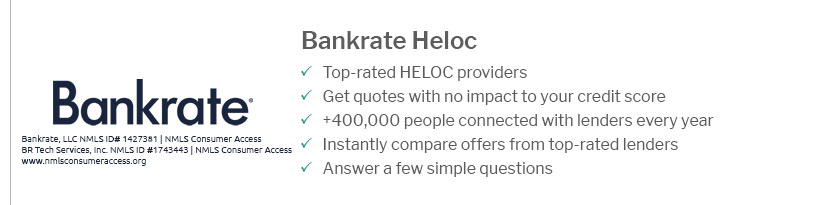

Potential DrawbacksWhile refinancing can offer many benefits, it's not without its drawbacks. It's important to consider the costs involved, such as closing costs, and the potential for extending the length of your loan. Current Market ConditionsThe decision to refinance often hinges on current market conditions, particularly interest rates. It's wise to refinance your mortgage now if interest rates are significantly lower than your current rate. However, predicting market trends can be challenging, so staying informed is crucial. Interest Rates TrendsMonitor the trends in interest rates, as they fluctuate based on economic conditions, Federal Reserve policies, and inflation rates. Personal Financial ConsiderationsYour personal financial situation plays a critical role in the refinancing decision. Consider your credit score, the length of time you plan to stay in your home, and your overall financial goals. Credit Score ImpactYour credit score can affect the interest rates offered to you. A higher score usually translates to better rates. Long-Term PlansIf you plan to stay in your home for a long time, refinancing might make more sense. However, if you anticipate moving soon, the costs might outweigh the benefits. Choosing the Right LenderIt's essential to choose from reputable mortgage refinance companies to ensure you get the best terms and service. Compare offers from different lenders to find the best fit for your needs.

FAQWhat are the typical costs associated with refinancing?Refinancing costs can include application fees, appraisal fees, closing costs, and other miscellaneous charges. These can range from 2% to 5% of the loan amount. How long does it take to break even on refinancing costs?The break-even point varies depending on the costs and how much you save monthly. Typically, it ranges from 2 to 5 years. Is it possible to refinance if my home has lost value?Yes, but it may be more challenging. Some government programs or lenders might offer refinancing options for homeowners with little or no equity. https://www.investopedia.com/mortgage/refinance/when-and-when-not-to-refinance-mortgage/

Historically, the rule of thumb has been that refinancing is a good idea if you can reduce your interest rate by at least 2%. However, many lenders say 1% ... https://www.kiplinger.com/real-estate/mortgages/should-you-refinance-your-mortgage-now-that-the-fed-just-cut-rates

Refinancing for a 0.25% lower rate is not generally recommended but could be worth it if you can refinance to consolidate high-interest debts, ... https://www.rate.com/resources/should-i-refinance-now

It's a type of mortgage that combines an initial period (typically, 5, 7 or 10 years) consisting of a low fixed rate followed by an adjustable rate period that ...

|

|---|